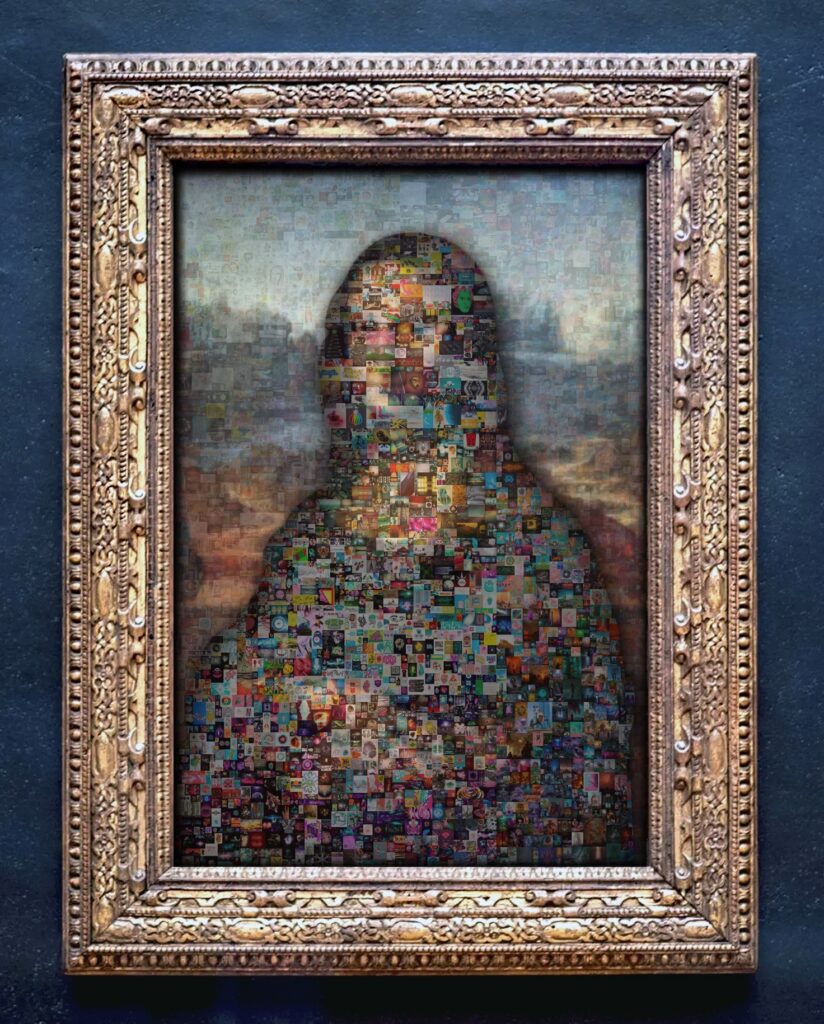

In the age of digitization, a new type of asset has gained popularity, attracting the attention of investors and researchers alike. These are non-exchangeable tokens, more widely known as NFTs (Non-Fungible Tokens) – unique digital assets that, unlike traditional currency or cryptocurrencies, cannot be replaced by other identical units. NFTs have become particularly well-known as a way to digitize and collect art, but their use extends to many other areas, from computer games to certificates of ownership.

Each NFT is unique, meaning it has a specific identifier and cannot be exactly copied or replaced with an equivalent unit. This makes NFTs seen as digital equivalents to unique works of art, valuable collector’s items or even real estate. Their value is based not only on the digital content they represent, but also on their uniqueness and limited availability.

Polish researchers vs. NFTs

Looking at the NFT market through the lens of scientists from the Institute of Nuclear Physics of the Polish Academy of Sciences in Krakow opens up new perspectives on understanding the phenomenon. By analyzing the NFT market in terms of global statistical features, the researchers enter a fascinating world where traditional concepts of value collide with modern technologies.

Traditionally, the value of money was based on the content of valuable metals, while today it is increasingly based on digital data. NFTs, which are unique digital assets, are the virtual equivalents of works of art or real estate. They are integrally linked to the cryptocurrency markets, but differ from them in that each NFT is unique and has an individual value.

Prof. Dr. Stanislaw Drozdz of IFJ PAN and the Cracow University of Technology notes that the NFT market follows the logic typical of collectibles, rather than the standard logic of currency markets. This approach prompted the team to do a broader analysis.

Trading in digital assets treated in this way is not guided by the logic of typical currency markets, but by the logic of markets that trade in collector’s items, such as paintings by famous painters.

– Prof. Dr. Stanisław Drożdż [1]

The NFT market gained popularity during the pandemic, as exemplified by the sale of the graphic-token “Everydays: The First 5000 Days” for $69 million. In their analysis, statisticians from IFJ PAN focused on five popular NFT collections on the Solan blockchain, examining parameters such as capitalization, minimum price, number of transactions, and value of transaction volume.

The analyses also included the Hurst exponent, which describes the propensity of a system to change trend. For the collections studied, the values of this exponent indicated the existence of some long-term memory, which is characteristic of high-profile markets.

The researchers also noted that the price of the cryptocurrency for which NFT collections are sold directly affects the volume they generate. Pawel Szydło, M.D., first author of the article in Chaos, stresses that cryptocurrency markets already show many signs of statistical maturity.

Our research further shows that the price of the cryptocurrency for which collections are sold directly affects the volume they generate. This is an important observation, as it is known that cryptocurrency markets are already showing many signs of statistical maturity

– Pawel Szydło, M.D. [1]

NFT characteristics

Research conducted by IFJ PAN indicates that the NFT market, despite its young age and different trading mechanisms, is beginning to function in a statistically similar manner to established financial markets. This indicates a possible universality among different types of financial markets, which requires further research for a more complete understanding.

Source:

[1] IFJ PAN Press Service, What does a physicist see when looking at the NFT token market?, https://press.ifj.edu.pl/news/2024/02/21/ [accessed March 6, 2024].

Cover photography: Pixabay

Zuzanna Czernicka